Wage Calculator Bc

The British Columbia Income Tax Salary Calculator is updated 202122 tax year. Calculate the total income taxes of the British Columbia residents for 2021.

Now you can go back to the Dues or Strike Calculator you were working on and enter the appropriate calculated amount into the Pay box on the left side.

Wage calculator bc. PLUS an average days pay for the stat holiday Calculation for pay on the statutory holiday. Formula for calculating net salary in BC The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and British Columbia Tax the Canadian Pension Plan the Employment Insurance. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

15x regular wage for the first 12 hours then 20x for hours worked above 12 hours. Gross annual income Taxes CPP EI Net annual salary. This calculator provides an overview of the annual minimum wage for workers in British Columbia BC excluding the compensation of days off and holidays thus the annual hours worked To calculate only the minimum annual salary including holidays simply indicate 0 in the field Holiday Statutory weeks.

The reliability of the calculations produced depends on the accuracy of the information you provide. When an employer provides extended health benefits it means that families do not need to purchase the extended health benefits themselves. Include all wages this includes salary commission statutory holiday pay and paid vacation.

2 hours at 15x 15 2250 per hour x 2 hours 4500 overtime. Take one of the two calculated amounts from the boxes on the right. Most working citizens in British Columbia reserve a privilege to a minimum level of pay through the National Minimum Wage.

This is general assistance intended to help workers and employers in calculating minimum wage entitlement. Formula for calculating net salary in BC. It is perfect for small business especially those new to doing payroll.

Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income. Your 2020 British Columbia income tax refund could be even bigger this year. The period reference is from january 1st 2021 to december 31 2021.

Gross annual income - Taxes - CPP - EI Net annual salary Net annual salary Weeks of work year Net weekly income. Employee worked 2 hours overtime 3. Net annual salary Weeks of work year Net weekly income.

The calculator is updated with the tax rates of all Canadian provinces and territories. All bi-weekly semi-monthly monthly and quarterly figures. Net weekly income Hours of work week Net hourly wage.

30 8 260 - 25 56400. The amount can be hourly daily weekly monthly or even annual earnings. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

Canadian Payroll Calculator by PaymentEvolution. Your average tax rate is 221 and your marginal tax rate is 349. That means that your net pay will be 40512 per year or 3376 per month.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Enter your annual income taxes paid RRSP contribution into our calculator to estimate your return. Annual salary calculator for the minimum wage in British Columbia BC for 2019 Enter the quantity of hours you work a week and Occasion Statutory weeks click on Convert Wage.

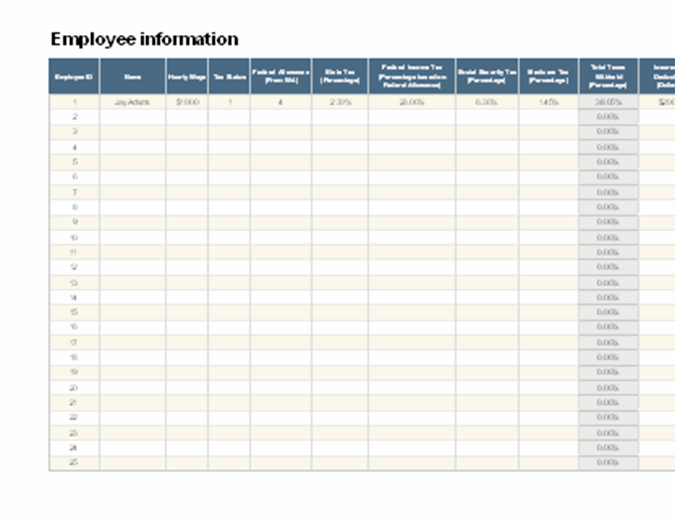

Usage of the Payroll Calculator. The adjusted annual salary can be calculated as. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

Semi-Monthly Paid Employees Only paid 2 times per month - 24 pay days per year. Our Minimum wage calculator British Columbia works as per the information you have entered and certain suspicions on wage calculation. The Living Wage for Families recognizes the value of non-mandatory benefits.

Average days pay for the stat holiday. Enter your pay rate. To start complete the easy-to-follow form below.

Total wages number of days worked statutory holiday pay an average days pay Base your calculation on days worked during the 30 calendar days before the statutory holiday include vacation days. Including the net tax income after tax and the percentage of tax. Formula for calculating net salary in BC The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and British Columbia Tax the Canadian Pension Plan the Employment Insurance.

The payroll calculator from ADP is easy-to-use and FREE. Use this calculator to decide. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Easy income tax calculator for an accurate British Columbia tax return estimate. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. You assume the risks associated with using this calculator.

Youll see what your wage amounts to when expressed as every of the common periodic terms. A living wage rate takes into account an employees total compensation package wage benefits. To calculate your Living Wage.

It will confirm the deductions you include on your official statement of earnings. This calculator include the non-refundable personal tax credit of Basic Personal Amount. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Regular hours 8 at 1500 12000 2. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

Different Types Of Payroll Deductions Gusto

Salary Inflation Calculator To Calculate Raise Needed To Keep Up Financial Motivation Personal Budget Money Advice

How To Calculate The Reservation Wage From Utility Function Youtube

Workers Compensation Perspectives Are Wages Or Salary Fully Covered By Workers Compensation Insurance

283 Bad Habits The Ultimate List Of Bad Habits Ideas Money Management Money Problems Managing Your Money

Living Wage Canada British Columbia

Cra Launches Calculator For Wage Subsidy Program British Columbia Real Estate Association

Plano Child Device Management Parental Lock Myopia Calculator App Child Support Quotes Truths C Parental Control Apps Child Support Quotes Child Support

Annual Employee Merit Increase Spreadsheet Excel Template For Etsy In 2021 Excel Templates Merit Spreadsheet

99 Alternatives European Flats Investing Alternative Investment Property

The Salary You Need To Be Paid In Every State To Afford A Home In 2021 30 Year Mortgage Buying Your First Home Poverty Rate

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Payroll Taxes For Your Small Business The Blueprint

8 Tips To Teach You How To Improve Your Credit Score Top5 Improve Your Credit Score Improve Credit Payroll

17th Worst Week For Mortgage Rates In History Biggest Jump In 41 Months Mortgage Rates Mortgage Interest Rates Mortgage Payoff

Bubblesort Bubble Sort Bubble Sort Algorithm Computer Programming

Petition Fight For 15 Bc Petition Wage Minimum Wage

Image By Ami Thomas On Life Hacks Phonetic Alphabet H Hotel Foxtrot

Post a Comment for "Wage Calculator Bc"