Gross Salary Per Annum

It is obtained by subtracting the Employers contribution to Provident Fund EPF and Gratuity from Cost to Company CTC. Calculate your annual salary with the equation 1900 x 26 49400.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Salary is employee provident fund and gratuity subtracted from the Cost to Company CTC.

Gross salary per annum. To put it in simpler terms Gross Salary is the amount paid before the deduction of taxes or other deductions and is inclusive of bonuses overtime pay holiday pay and other differentials. Pay Related Social Insurance PRSI is a tax payable on the gross income after deducting pension contributions. The gratuity amount depends upon the tenure of service and last drawn salary.

You may be able to rule out a potential job offer when considering other costs associated with the increase. Is a progressive tax applied on the gross income after certain capital allowances but before pension contributions. Traductions de expression MULTIPLIED BY THE GROSS SALARY PER ANNUM du anglais vers français et exemples dutilisation de MULTIPLIED BY THE GROSS SALARY PER ANNUM dans une phrase avec leurs traductions.

Gratuity Basic salary Dearness allowance 1526 No. Multiply this amount by the number of paychecks you receive each year to calculate your total annual salary. Suppose you are paid biweekly and your total gross salary is 1900.

Calculate your annual salary. Ninety-four United States dollars per annum corresponding to a gross salary of 186094 one hundred and eighty-six thousand ninety-four United States dollars per annum. Of Years of Service.

De très nombreux exemples de phrases traduites contenant net salary per annum Dictionnaire français-anglais et moteur de recherche de traductions françaises. Shes 22 and is eligible for the National Minimum Wage rate of 836 per hour. She gets paid monthly 12 times a year so each pay packet covers an average of 170 hours 2040 divided by 12.

These calculations are based on the tax year 2021-2022 ending 5 April 2022 These calculations assume sole. Find your total gross earnings before deductions on your pay stub. Gross salary is the amount of salary after totalling all the benefits and allowances but before deducting any tax while net salary is the amount that an employee takes home.

Was set at EUR 5 59959 gross per annum EUR 6 36365 as at 1 December 2006 for those living with one or more other persons and EUR 8 39939 gross per annum EUR 9. Individuals that earn less than 12012 EUR per year are exempt from the Universal Social Charge. For example a comparison of a 30000 salary against a 35000 salary a gross difference of 5000 results in a net difference that is different due to tax and other deductions.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own. De très nombreux exemples de phrases traduites contenant gross salary Dictionnaire français-anglais et moteur de recherche de traductions françaises.

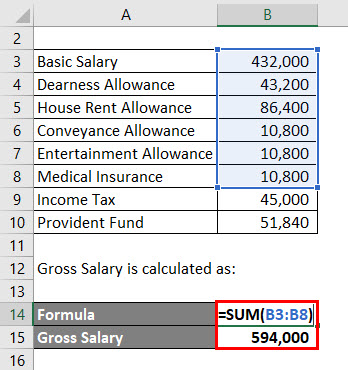

An individuals gross salary is inclusive of benefits such as HRA conveyance allowance medical allowance etc. Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear. Gross Salary Cost to Company CTC - Employers PF Contribution EPF - Gratuity Gratuity calculation.

A gross fixed salary of 500000 euros per annum and variable portion of 460000 euros. On the other hand if the salary increase is via a pay rise then you can see exactly how much that pay rise is worth. Net Salary Gross salary - All deductions like income tax pension professional tax etc.

PRSI is only applicable to salaries higher than 5000 EUR per year. Multiplied by the gross salary per annum by grade. To calculate Income Tax gross salary minus the eligible deductions are considered.

It can be used for the 201314 to 202021 income years. We start with calculating the Gross salary as follows. Gross salary CTC - PF - Gratuity.

Therefore Net Salary Gross Salary Deductions Rs70000 Rs14000 Rs56000. Employees provident fundPF is calculated as 12 of Basic salary. It is calculated according to this formula.

Taxation Process of Gross Salary. Last drawn salary basic salary plus dearness allowance X number of completed years of service X 1526. A pay period can be weekly fortnightly or monthly.

This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. Gross salary is not your basic salary nor your CTC. Net salary is also referred.

The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. For instance you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for.

Salary Formula Calculate Salary Calculator Excel Template

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Salary Know How To Calculate Gross Salary Or Ctc

100 000 After Tax 2021 Income Tax Uk

How Much Salary Will I Get At 5 Lac Ctc Quora

What Is Annual Net Income Mintlife Blog

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Salary Formula Calculate Salary Calculator Excel Template

Gross Annual Income Calculator

Annual Income Learn How To Calculate Total Annual Income

Salary Formula Calculate Salary Calculator Excel Template

French Minimum Wage And Average Salary In France Expatica

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How Much Salary Will I Get At 5 Lac Ctc Quora

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Post a Comment for "Gross Salary Per Annum"