Gross Salary For Pf Calculation

To simply the math assume that your basic salary is Rs25000 including dearness allowance. PF calculated on Gross Salary.

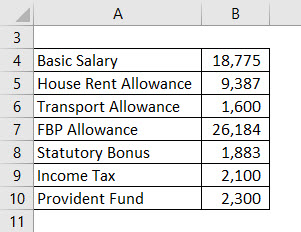

Basic Salary Calculation Formula In Excel Download Excel Sheet

Switching to calculating PF on gross salary 1.

Gross salary for pf calculation. Employees whose Basic plus DA is more than Rs 6500 per month. PF Gross includes Basic DA Conveyance Other Allowance etc. PF Deduction on Salary above 15000.

But from now onwards it includes BasicDAAllowances. Previously as the meaning of salary was only BasicDA so 12 of Rs30000Rs3600 was considered for EPF payout from your end and equally from your employer end too. The formula for Gross Salary is defined as below.

For example if the PF Gross is Rs 2000 per month and the minimum wages is Rs 3000 the PF department may not accept. The formula for Gross Salary is defined as below. Some for the popular or common allowances in the bifurcation of emoluments are special allowanceHouse Rent Conveyance City Compensatory Education Leave Travel Washing Attendance Performance Incentive Cash Handling Lunch Overtime etc.

Organisations that employ 20 or more employees have to register with the Employees Provident Fund Organisation EPFO for paying EPF to employees. For employees whose earned Basic plus DA is more. There are many online PF calculators that help you calculate your PF amount.

Daily wages are calculated using either the gross rate for paid public holidays paid leave salary in lieu and salary deductions or the basic rate for work on rest days or public holidays. Definitions and calculation You may receive a monthly or daily salary. Let us consider PF Gross to denote the salary to be considered for PF calculation.

So your total salary from above example will be Rs46000. It excludes House Rent Allowance Bonus etc. Moreover employees earning less than INR 15000 per month as basic pay and Dearness Allowance have to mandatorily.

Variance Bonus related to pieces stitched over regular production. Calculation of PF from gross salary. GROSS FIXED SALARY.

For organisations having less than 20 employees EPF registration is voluntary. How to calculate EPF contribution. Calculate PF on gross pay and NOT on Basic head of pay Part I Posted by gautham on December 29 2012.

Salary for PF calculation should not be less than minimum wages In a recent circular the PF department has stated that the salary for the purpose of PF calculation should not be an amount which is less than the minimum wages as specified by the Minimum Wages Act. Practically the emoluments are split into various allowances without considering as to for what. Heads of pay which are included for PF calculation and excludes House Rent.

If the employee salary increases to above 15000 due to salary hike and if he is previously an EPF member then he should continue making PF contribution. And the PF is calculated on 15000 only. The calculation of Gross pay for the purpose of PF calculation is different than that used in the payroll context.

The final salary computed after the additions of DA HRA and other allowances. For the sake of clarity we will use the term PF Gross in this post to denote the salary to be considered for PF calculation. A recent article on Provident Fund PF deduction in the Times of India has led to a number of employers and employees believe that there will be a significant increase in PF deduction in the near-future.

If the salary basic wage DA of an employee is 15000 from the starting date of his joining then it is not mandatory to deduct PF from his salary. There are three rules for PF calculations 1 12 of your basic salary 2 12 of your basic salary and capped at 1800-3 12 of PF your gross-HRA and capped at 1800-Please check your PF calculations as per above rules to get correct PF amount. Heads of pay which are included for PF calculation.

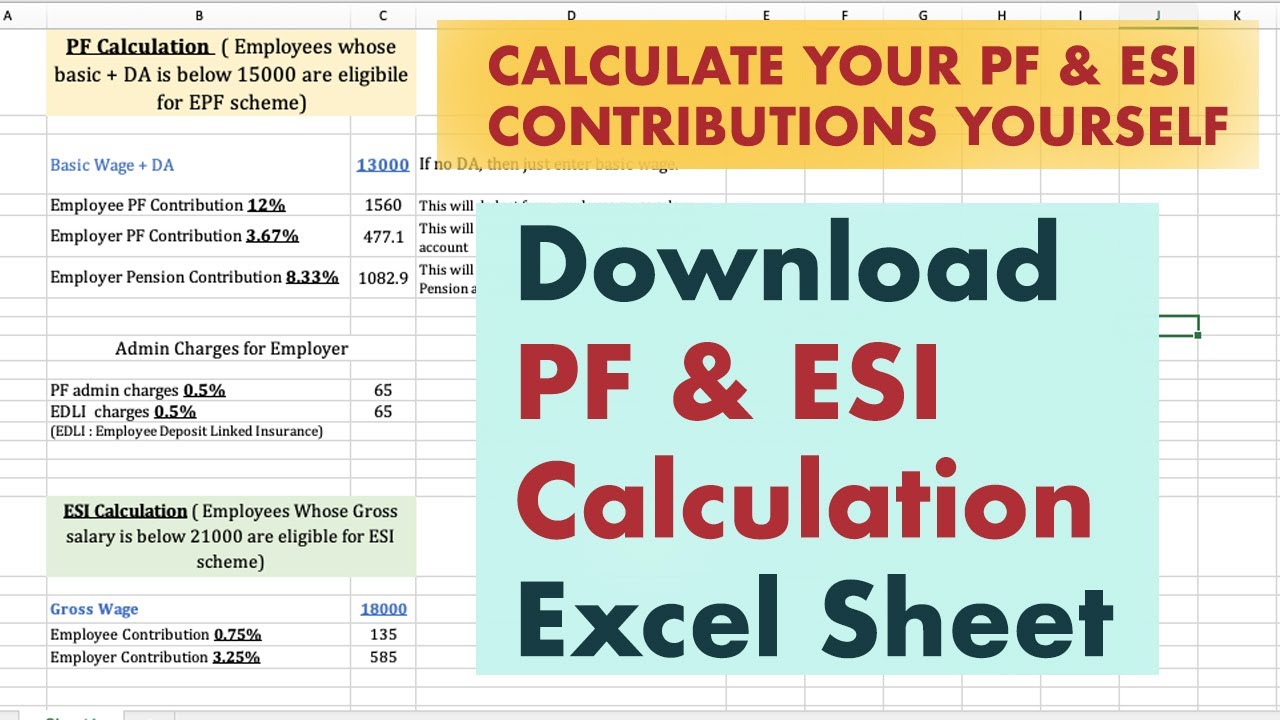

Rs15000-Employee contribution toward EPF will be 12 15000 Rs1800-The remaining 833 will be multiplied by Rs15000- this adding up to Rs12495-When the monthly basic salary is above Rs15 000 then you can use any of the methods below to calculate PF amount for a salaried employer. Just enter your basic wage or gross salary to automatically calculate your monthly PF ESIC contributions Download PF ESI Calculation Excel Format 2021 The above excel format is updated as per the latest EPF and ESIC calculation formulas. Gross Salary Basic HRA DA Allow PF.

Gross pay for the purpose of PF calculation is different from the term gross pay which is typically used in the payroll context. Your EPF contribution Your contribution towards EPF is 12 of Rs25000 which amounts to Rs3000 each month. On most PF calculators you need to input details such as.

PF Gross includes Basic DA Conveyance Other Allowance etc. Define PF Gross for the purpose of PF calculation. According to the article as per a recent directive from the PF department employers.

Your current age and the age when you want to retire Your basic monthly salary and the average annual expected increase. Monthly and daily salary. Contribution to EPF will be 12 of Rs46000 which is Rs5520.

Please examine the heads of pay in the pay structure used in your. Heads of pay which. Employees monthly basic salary Dearness Allowance.

Salary Calculation Gross to Net Salary Net to Gross Salary Calculation of Severance and Notice Pay You can use PwC Turkeys calculation module to calculate your 2021 Gross to Net Salary Net to Gross Salary Calculation of Severance and Notice Pay. SALARY FOR PF CALCULATION. This amount is calculated each month.

How To Calculate Pf And Esi With Example In 2018

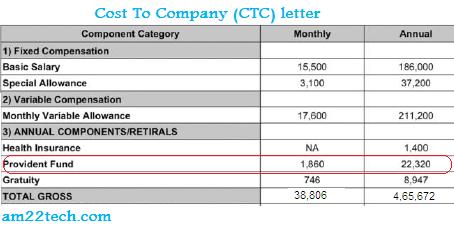

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Salary Breakup Calculator Excel 2021 Salary Structure Calculator

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Pf Esi Calculation Excel Format 2021 Download

What Is Gross Salary How To Calculate Gross Salary

Pf Esi Calculation Excel Format 2021 Download

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Epf Vs Ppf Vs Vpf Ctc And Salary Slip India

Pf And Esi Calculation Excel Sheet 2021 Calculate How Much Pf Esi You Are Contributing Youtube

Salary Net Salary Gross Salary Cost To Company What Is The Difference

What Are The Difference Between Ctc Basic Salary And Gross Salary Quora

Pf Calculator Calculate Epf Provident Fund By Epfo

C Program To Calculate Gross Salary Of An Employee

Salary Formula Calculate Salary Calculator Excel Template

What Is Gross Salary How To Calculate Gross Salary Learn By Quickolearn By Quicko

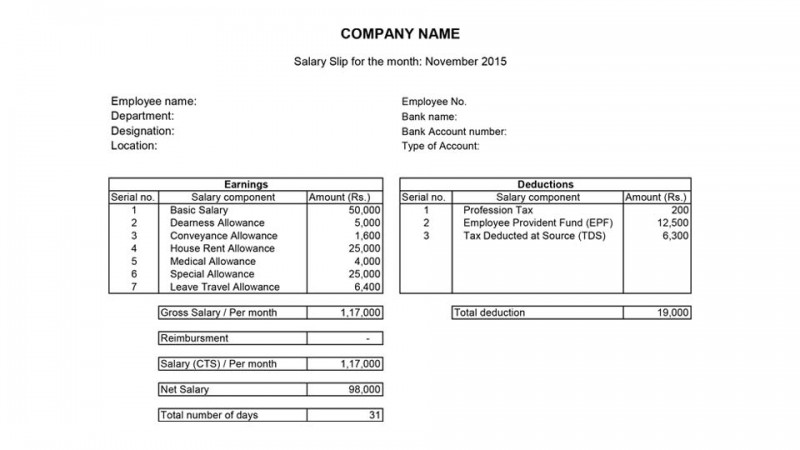

Simple Salary Slip Format For Small Organisation In Excel Format

Salary Formula Calculate Salary Calculator Excel Template

Post a Comment for "Gross Salary For Pf Calculation"