Annual Income Tax

Income tax is calculated on annual basis in India. INR 250001 INR 5 lakhs.

The annual income tax return summarizes all the transactions covering the calendar year of the taxpayer.

Annual income tax. The federal income tax system is progressive so the rate of taxation increases as income increases. Updated with the platest UK personal income tax rates and thresholds for 2021. Constant and effective communication will be kept Fiverr.

Income tax is the normal tax which is paid on your taxable income. Paying Income Tax is a duty of every Indian citizen. Income Tax is a tax on a persons income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 Tax Code as amended less the deductions if any authorized for such types of income by the Tax Code as amended or other special laws.

Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year. Annual income hourly wage hours per week weeks per year If you want to do it without the yearly salary income calculator substitute your numbers into this formula. The income slabs keep changing from year to year.

A resident citizen engaged in trade business or practice of profession within and without the Philippines. If youre still confused about how to find annual income have a look at the examples. One of a suite of free online calculators provided by the team at iCalculator.

Each tax subject that derives income from conducting business activities must lodge an annual income tax return. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. It also will not include any tax youve already paid through your salary or.

Under the Income Tax Act 1961 the percentage of income payable as tax is based on the amount of income youve earned during a year. This return shall be filed by the following individuals regardless of amount of gross income. Before you use the calculator.

The individual income tax rates will depend on the income year you select and your residency status for income tax purposes during that income year. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. 30 4 cess on income tax.

5 4 cess on income tax. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Above INR 10 lakhs.

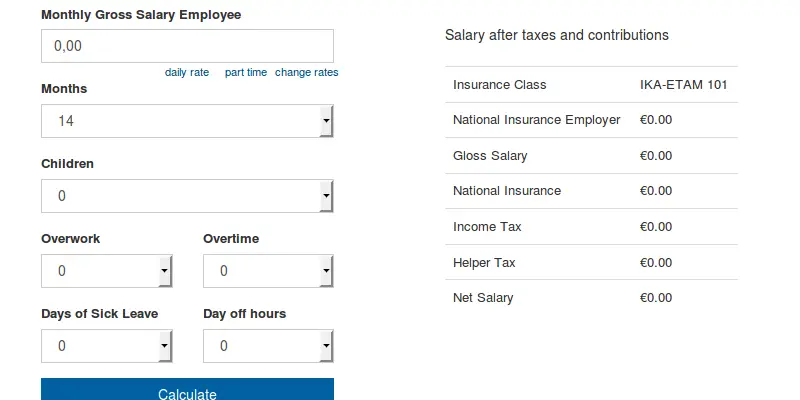

The Annual tax calculator is a comprehensive calculator for salary income tax dividends overtime pay rise and payroll calculations online. Annual Income Tax Return Tax on other income is calculated when you complete an Annual Income Tax Form which details your assessable income and any expenditure you can deduct against income. Examples of amounts an individual may receive and from which the taxable income is determined include Remuneration income from employment such as salaries wages bonuses overtime pay taxable fringe benefits allowances and certain lump sum benefits.

The tax applies to the Range of income which is called Income Tax Slabs. The formula for the annual income is. INR 500001 INR 10 lakhs.

Up to INR 25 lakhs. 20 4 cess on income tax. A resident alien non-resident citizen or non-resident alien individual engaged in trade business or.

Income in America is taxed by the federal government most state governments and many local governments. Computations will be shared with clients till their satisfaction. Marginal tax rates range from 10 to 37.

It is calculated for the financial year starting from 1st April and ending on 31st March. For only 25 Shtaxaition will file your annual income tax return for 2021 or 2020. Enter your financial details to calculate your taxes.

Part-year residents may be entitled to a part-year tax-free threshold. Who Must Lodge an Annual Income Tax Return. Foreign residents are taxed at a higher rate and arent entitled to a tax-free threshold.

Ill be computing and submitting your income tax returns. The speakers will discuss Californias personal income tax rules for characterizing income and sourcing sales of intangibles with a heavy focus on the Office of Tax Appeals controversial Metropoulos decision holding that flow-through gain from an S corporations sale of goodwill should be sourced under California Code of Regulations title 18 section 17951-4 rather than California Revenue and Taxation Code.

What Is Irs Form 1040 Income Tax Return Tax Return Tax Time

Tax Return Fake Tax Return Income Tax Return Bank Statement Generator

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Tax Return Income

Tables Charts Chart Design Chart Logo Graphic

Found On Bing From Www Imoney My Income Tax Income Tax Return Tax Deadline

Budget 2020 Highlights Budgeting Income Tax Income

Today S Document From The National Archives Income Tax Tax Forms Federal Income Tax

Old Or New Tax Slabs For Fy 2020 21 Amount At Which Tax Are Same Incometax Budget Unionbudget2020 Oldvsnew Income Tax Indirect Tax Budgeting

New Income Tax Table 2020 Philippines Tax Table Income Tax Tax

Today Marks The Last Day For Filing Annual Income Tax Returns Fbr Income Tax Tax Return Income Tax Return

Income Tax Filing Services Income Tax Filing Taxes Personal Savings

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Types Of Taxes

Fillable Form 1040 Individual Income Tax Return In 2021 Income Tax Return Tax Return Income Tax

Magdalena Schmitz Has Undergone Some Major Changes Chegg Com Homework Help Income Tax Return Change

Income From House Property House Property Income Determination Of Annual Value Notes House Property Income Tax Notes Dedu House Property Income Income Tax

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Irs Taxes

How I Filed My Own Itr For The 1st Time One Day Kaye Income Tax Return Filing Taxes Tax Return

Post a Comment for "Annual Income Tax"