Gross Salary Meaning Singapore

This is payment that does not vary from month to month regardless of employee or company performance and regardless of whether the employee takes medical or personal leave. Salaries are different between men and women.

Average Salary In Singapore 2020 Average Monthly Earnings Ame Explained Turtle Investor

For calculation of Income Tax gross salary minus the eligible deductions are considered.

Gross salary meaning singapore. Taxation Process of Gross Salary. Total wages excludes employer CPF contributions. Gross salary calculation can be initiated with the help of this mathematical formula.

Gross Monthly Wage is defined as the total wages paid by the employer to the employee in the calendar year divided by the number of months in which CPF contributions were made. Gross salary also called Cost to Company CTC is the total amount of salary that an employer pays an employee. The median Singaporean generates a gross income of approx.

Gross monthly income from work refers to income earned from employment. Women receive a salary. This includes amortisation of annual bonuses 112 of the amount but excludes taxes.

Taxation Process of Gross Salary. DefinitionDifference Explanation Examples - YouTube. Gross rate of pay includes allowances that an employee is entitled to under a contract of service What is excluded Gross rate of pay excludes.

It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Singapore affect your income. Every form of wage including basic salary allowances bonuses etc comes under gross salary actually it is a general term for total wagesalary.

Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health. Assuming that a couple both generate 4000month resulting in a gross household income of 8000month they can actually afford a 2-bed condo but barely. Also known as Gross Income.

It is the gross monthly or annual sum earned by the employee. Overtime payments bonus payments and annual wage supplements AWS. Gross salary is calculated by adding an employees basic salary and allowances prior to making deductions including taxes.

Salary Before Tax your total earnings before any taxes have been deducted. These are monthly allowances that do not vary from. The gross salary denotes the maximum compensation that the employer pays to each of its employees.

Average Salary Singapore. Total wages includes all allowances and payments that attract CPF contributions including basic salary overtime pay commissions and bonuses. For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax.

For example you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for calculation of taxable income. Therefore Net Salary Gross Salary Deductions Rs70000 Rs14000 Rs56000. Gross Income PaySalary etc in One Minute.

Reimbursement of special expenses incurred in the course of employment. Men receive an average salary of 104691 SGD. Youll then get a breakdown of your total tax liability and take-home pay.

All data are based on 3277 salary surveys. It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses. Residents refer to Singapore Citizens and Permanent Residents.

Gross salary Basic salary HRA Other Allowances. To calculate Income Tax gross salary minus the eligible deductions are considered. Gross monthly household income is defined as the total amount of income from employment or business earned by all members from the same household excluding foreign domestic workers.

Here a basic salary is the base income of an employee or the fixed part of ones compensation package. Average salary in Singapore is 90522 SGD per year. The most typical earning is 48904 SGD.

For instance you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for. Fixed monthly salary basic monthly salary fixed monthly allowances. For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax.

Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted. It includes all the allowances and perquisites provided by the employer. So Net Salary Gross Salary Deductions Rs83000 Rs13000 Rs70000.

Understand The Individual Income Tax In China Itt Ins Global

Pr Application Basic Salary And Gross Salary Singapore Expats Forum

Incomes Up For Singapore Households Last Year Singapore News Top Stories The Straits Times

Average Salary In Singapore 2020 Average Monthly Earnings Ame Explained Turtle Investor

Salary Calculator Difference Between Gross Salary And Net Salary

What Is Cpf The Complete Guide To Cpf Cpf Submission In Singapore

Working Adults What Is A Good Salary In Singapore

Understanding Gross Vs Net Moneyhub Nz

Employee Salary Calculations Deductions Unpaid Salary More Singaporelegaladvice Com

Pr Application Basic Salary And Gross Salary Singapore Expats Forum

Average Salary In Singapore 2020 Average Monthly Earnings Ame Explained Turtle Investor

How To Read Singapore Form Ir8a Tax Questionnaire Tq Help

Household Monthly Income Per Person Calculator

Average Salary In Singapore 2020 Average Monthly Earnings Ame Explained Turtle Investor

How Much Money Do You Actually Take Home If You Earn The Median Salary In Singapore

What Is A Good Pay In Singapore Quora

What Does Monthly Deduction For Others Actually Mean Twc2

Jobs And Salaries Of Social Work Graduates 2009 2011 Social Dimension Singapore

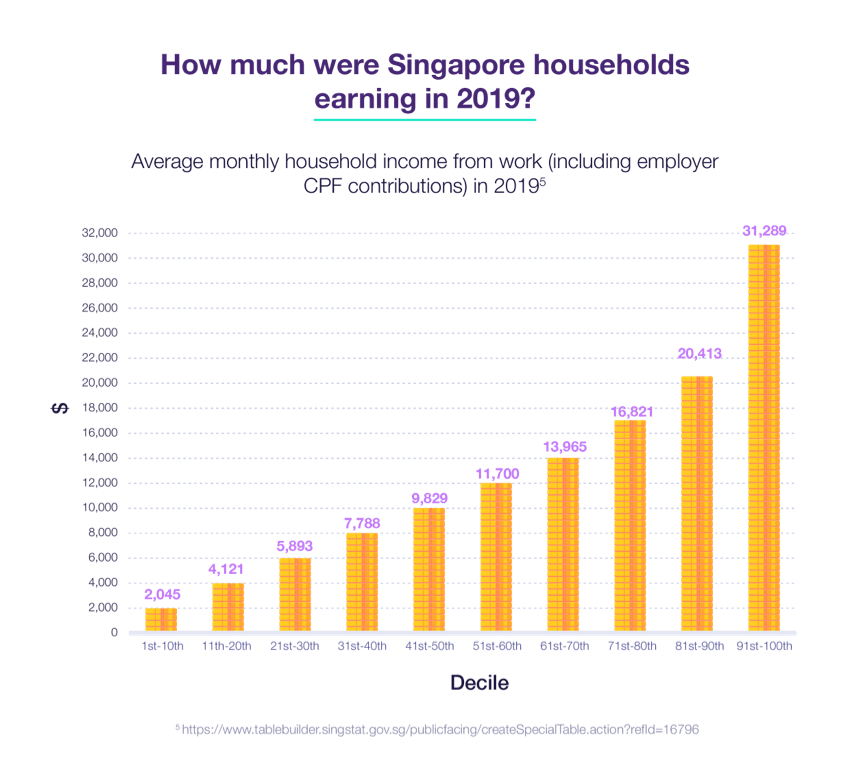

Are You Earning Enough Singapore S Average Household Income Revealed Standard Chartered Singapore

Post a Comment for "Gross Salary Meaning Singapore"